Experts estimate that over 76.5 million Americans do not have dental insurance. And for those with dental insurance, finding a family dentist who accepts their plan can be a challenge. When you are hunting for a family dentist, there are specific things to take into consideration. This article offers nine tips on choosing the right family dental care plan.

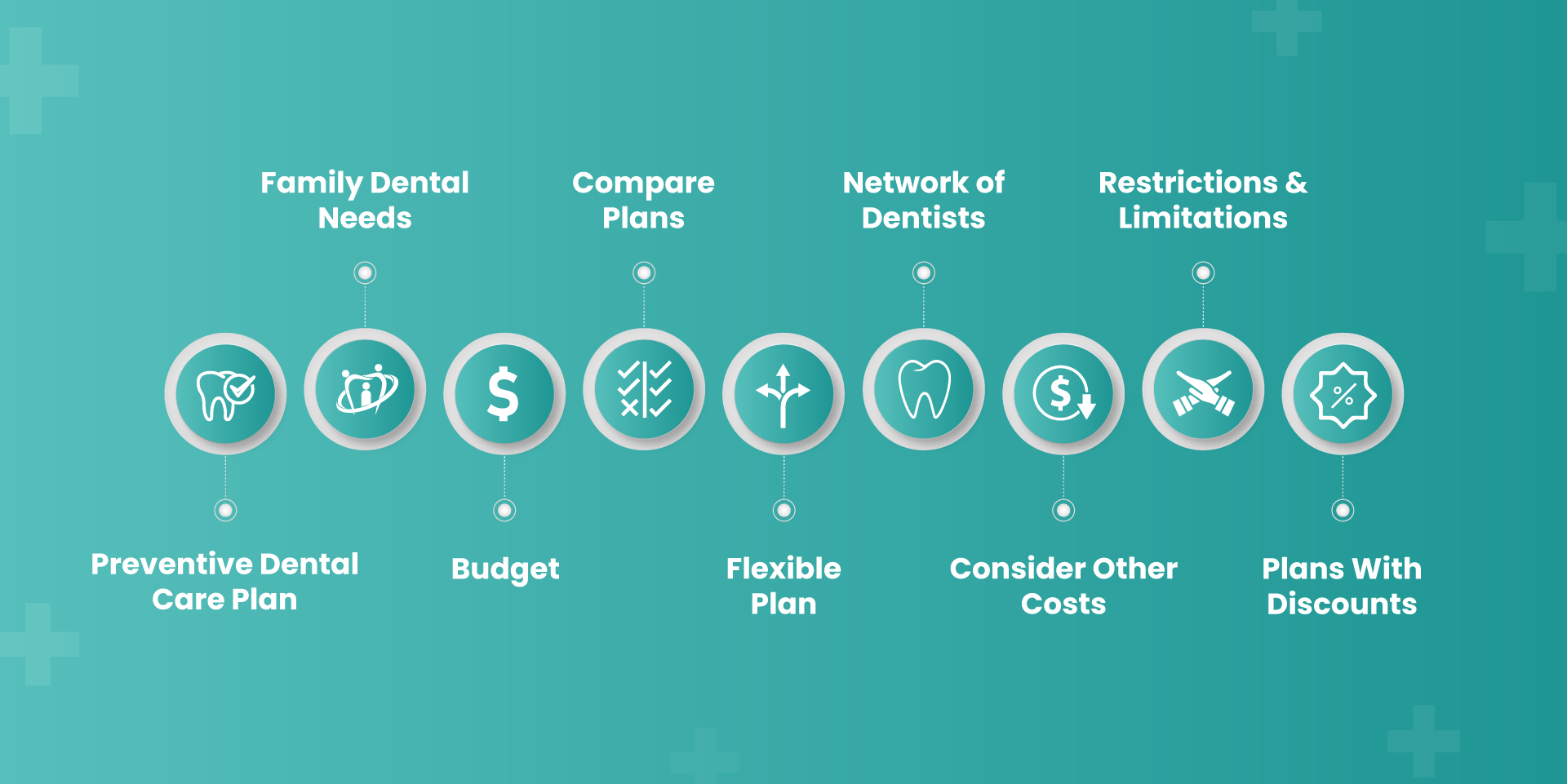

1) Look For A Plan That Covers Preventive Care

Preventive dental care is essential for maintaining good oral health and preventing serious dental problems. A family dental plan that covers preventive maintenance will save money on expensive treatment costs in the long run. Here is the coverage to look for:

- Regular checkups and cleanings - Most family dental plans cover two routine checkups and cleanings per year. This is important for catching minor problems before they become big expensive ones.

- Fluoride treatments and sealants - Fluoride treatments strengthen enamel and prevent cavities, and sealants protect teeth from decay.

- Discounts on other preventive services - Some plans offer discounts on other preventive services, such as x-rays, oral cancer screenings, and gum disease screenings.

- Waiting period - Look for plans (Example: Physicians Mutual) with no waiting period for preventive care.

- No out-of-pocket costs - Some family dental plans that cover preventive care come with a catch. Hence look for one with no hidden fees, such as Delta Dental.

2) Determine Your Family's Dental Needs

It's wise to consider how often your family visits the dentist. If you only go once or twice a year, you may not need a plan with more extensive coverage. Some people must see the dentist more frequently than twice a year. Find a plan with coverage for the services you use most often. Knowing your family's needs will help you narrow down your choices.

To begin with, find answers to the following questions.

- Do you have young children who will need regular cleanings and checkups?

- Do you have teens who may need orthodontic work?

- Do you have adults with special needs, such as dentures?

- Do you have an athlete in your family with risks of injury?

- Are any of your family members dealing with more serious dental issues that require regular visits to the dentist

- Does everyone see the dentist regularly for cleanings and checkups?

Your perfect plan will address your questions with solutions. Knowing which services your family needs will help you choose a plan that covers those services.

3) Consider Your Budget

Of course, your budget is a consideration when zeroing in on a family dental plan. It’s tricky to find insurance with the best value for all family members.

Consider these two factors when budgeting for a family dental plan:

- The size of your family: The larger your family, the more expensive the dental plan. But remember to factor in things like how often each member of the family sees the dentist. You should budget for more frequent visits if you have a large family with several young children.

- Your location: Where you live can also affect the cost of your dental plan.

4) Compare Plans

There is more than one factor to consider when comparing plans, including the type of coverage offered, the deductible and co-payments required, and the providers included in the plan's network. By comparing plans, you can ensure the best value for your family's dental care needs.

5) What Is The Network Of Dentists In The Plan

You may search for a dentist on the American Dental Association (ADA) website. The size and scope of the network will determine how many dentists are available to see patients and how convenient it is to find a dentist near you. You will want to minimize travel time when several family members see the best dentist regularly.

6) Check If The Plan Is Flexible

Consider a plan that can accommodate your family's changing needs. For example, if your family is growing, the young children will need to be seen once their teeth erupt in the first year. You will want to ensure that the plan includes dental visits and cleaning coverage.

7) Take Other Costs Into Consideration

In addition to the monthly premium, you should consider the out-of-pocket costs associated with the plan. This includes things like deductibles, copays, and coinsurance.

8) Look For Restrictions/Limitations

Some plans may have age limits, while others may only cover specific dental procedures. Read the fine print and understand the restrictions and limitations before enrolling in an insurance plan. It will pay off to scrutinize the details of a plan before signing on the dotted line.

9) Look For Plans With Discounts

Some plans will offer a percentage for specific procedures (usually costly) if you use their network of dentists. This can save you considerable money, so ask about this before enrolling in a plan.